post filed in:

How to Achieve Business Budgeting Confidence as a Creative Entrepreneur using the Profit First Model

Do you feel like you make a decent amount of money in your creative business, but you’re always wondering how it’s all gone so quickly and where it went?

Do you struggle to plan financially for the inevitable slow and busy seasons as an entrepreneur and have confidence that your business will be sustainable?

Hey everyone, Kira here! Colorado Springs wedding, family, and personal brand photographer and I’m so excited to share a budgeting system with you that truly changed my life as a small business owner.

I am no finance guru. In fact, the most money training I’ve had was one accounting class in college until I changed my major so I didn’t have to take another one. I say that to show you that this system works even for non-number loving people!

This post may contain affiliate links, meaning I make a small commission if you use them to purchase any products. Please know I only recommend tools and products that I absolutely love and have found helpful in my own business.

The system this overview is based on is a book called Profit First by Mike Michalowicz. It literally took me from having no clue or plan for how to budget in my photography business to feeling confident in exactly how much I can spend on any given day and being able to pay myself consistently despite extreme differences with slow and busy months.

During the first two months of COVID-19 when all essential businesses were shut down and I wasn’t allowed to do any photo sessions and even lost two weddings, I was still able to pay myself the exact same amount as usual because of how this system naturally prepares for ups and downs – even though I wasn’t expecting it!

The basic premise is similar to Dave Ramsey’s envelope system, just online and for your business. The idea is to organize your bank accounts so that you have a separate account for each category, instead of looking at one large sum in an account since that makes you feel like you have more money to spend than you do.

Step 1: Organize Your Bank Accounts

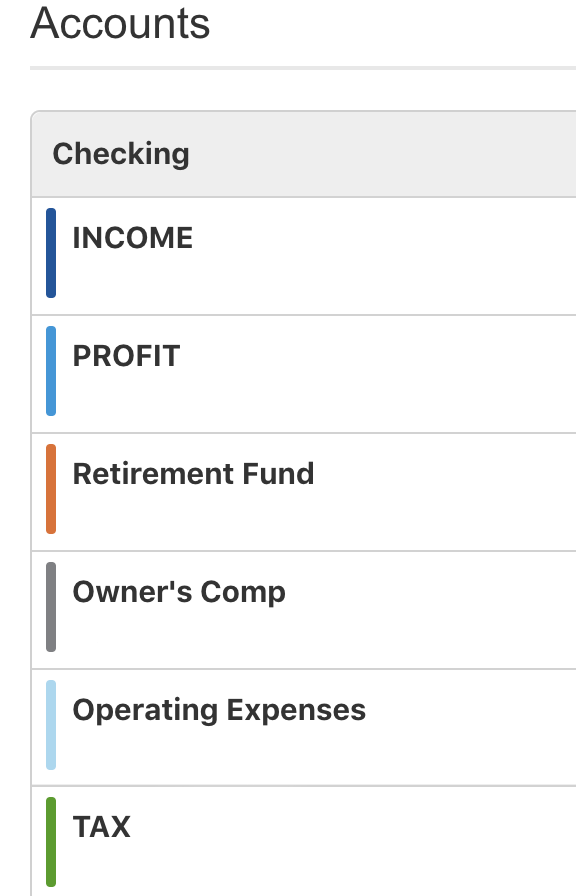

Everything you make goes into a checking account labeled INCOME (typically the account you already have set up to receive payments into). Then you open up 4 other checking accounts and label them:

- Owner’s Compensation

- Operating Expenses

- Profit

- Taxes

Then you also create 2 Savings accounts in a totally separate bank and label them:

- Profit

- Taxes

He suggests making these 2 accounts separate and harder to get to since it’s the money you don’t want to feel like you have. I’ll explain why they have the same labels as a couple of your checking accounts in the original bank in a moment.

Basically, everything you make goes into your Income account and then on the 10th and 25th of every month, you transfer all of it into your other accounts, based on percentages.

Because of this, the point of your Income account is to end up at $0 twice a month, which means you’ll want to make sure your bank does not have any required minimum balance for that account.

Several other accounts will end up at $0 as well so be sure this is the case for all of them. If there is a minimum balance requirement, just call your bank and ask them to remove it. If they won’t, tell them sorry but you’ll find another bank who will and they will most likely remove it.

Step 2: Set Your Profit First Percentages

In the book, the author gives suggested percentages based on business size for maximum success with this system. It was so helpful for me to see roughly where I was since I had to idea how much of my Gross income I should be paying myself or putting back into growing my business. Truth be told, I didn’t even know that Profit was ABOVE AND BEYOND what I pay myself (owner’s compensation)! More on that in Step 4.

While he suggests determining where you are currently with these and then adjusting incrementally to get to this point sustainably, here are the suggested ideal percentages for each category based on a small business (solo entrepreneurs or small teams):

- 50% Owners Compensation

- 30% Operating Expenses

- 15% Taxes

- 5% Profit

I have been using my own spin on the percentages since I like to save for retirement out of my Gross income instead of a smaller percentage of my Owner’s Comp. So here are the percentages I have set for myself:

- 40% Owners Compensation

- 25% Operating Expenses

- 15% Taxes

- 15% Retirement

- 5% Profit

Step 3: Making Your Percentage Allocations Twice A Month

On the 10th and 25th of each month, take the amount of money currently in your Income account and transfer your allocated percentages into each of your other checking accounts accordingly. Then do the following:

- Connect your separate bank and transfer the entire amounts from your Profit and Taxes checking accounts to the Savings accounts in the other bank so you don’t see them every day or feel like you even have the money (we’re less likely to spend it that way)

- Hopefully you will have an estimate for roughly how much you make per year, so take 50% of that (or 40% if you use my percentages), divide it by 12 and that should be your target for how much to pay yourself each month. Now you will pay yourself from your Owner’s Compensation account (I just connected it to PayPal and send it that way twice a month to my personal bank account)

- Pay off your business credit card out of your Operating Expenses account. You don’t HAVE to have a credit card, but I have found this system works the easiest that way since you can easily pay it off out of the right account. If you need a suggestion, I’d highly recommend the Chase Inc Business Preferred card as you get triple points on things like advertising, shipping, etc. as well as additional rental car coverage for business trips. The points can easily be transferred to multiple different airlines which is what I use them for the most!

- Use this link to receive 80,000 bonus points when you spend a certain amount in the first 3 months! It’s so worth it!

Since you are putting a percentage into your Owner’s Compensation account, but only taking out a certain amount based on your projections for the year, as you go through busy season the amount in the account should grow enough to then cover you during the slow seasons. It’s so genius!!

Step 4: What is Profit

As previously mentioned, before reading this book, I thought that my Gross income – operating expenses equalled my profit. But it turns out that we still need to pay ourselves and this is something totally separate from profit!

Profit is the amount saved above and beyond everything else, including payroll. It is not meant to be put back into your business, because that would then just mean that it’s an operating expense. Instead, based on the Profit First model, it’s there for two reasons:

- Use it as an emergency fund for your business. Most businesses don’t have enough cash reserves to keep their doors open for longer than a couple months in the case of disaster like injury or, God forbid… a global pandemic. This profit fund can give you peace of mind that if things don’t go exactly as planned, you won’t have to shut down.

- Give yourself a quarterly bonus!! Once you have a 6 month emergency fund build up, it’s time to celebrate. After all, we become entrepreneurs because we want to experience freedom and have our businesses serve US, not become slaves to the work. So by giving ourselves a bonus of HALF of what’s in our profit account (beyond the 6 month emergency fund) each quarter to be spent on things like travel and fun, we are able to avoid burnout and continue loving our business as it loves us back.

Does this system sound like it would be a good fit for you and your business?? If so, I’d highly recommend purchasing the book as it goes into much, much more detail and will help you determine Current Allocation Percentages and your Target Allocation Percentages in order to move forward sustainably.

Want to be a part of my little community of creative entrepreneurs? Join my free Facebook education group where we’re learning and growing together!

the list

Be the ultimate insider. Get updates on my latest shoots, tips for planning your dream photo session & where I'm headed next. My email subscribers always hear about big updates before anyone else!

JOIN THE FUN

education Community

Are you a creative entrepreneur? Come join my small but mighty education community, where we are learning and growing together! I'm an open book and love to share about all the photography & business stuff behind-the-scenes stuff here!

Let's Grow Together!